IDC: Coronavirus presents opportunities for ICT vendors

The COVID-19 outbreak will bring both challenges and opportunities for the ICT market, according to IDC.

The virus, which began in Wuhan, China late December 2019 has continued to spread – bringing shutdowns in extensive sectors including food services, retail, entertainment, and tourism in the traditional Chinese New Year festival season, with many companies delaying resume of operations until late February. The outbreak has not only affected social production and everyday life but has also taken a toll on the Chinese and global economy, as well as the ICT market.

"The COVID-19 outbreak will have a greater impact on the overall economy than the SARS outbreak in 2003. We expect the impact to be significant in the first quarter, but gradually lessen in subsequent quarters – with a limited impact on the full-year economic growth," says Kitty Fok, managing director of IDC China.

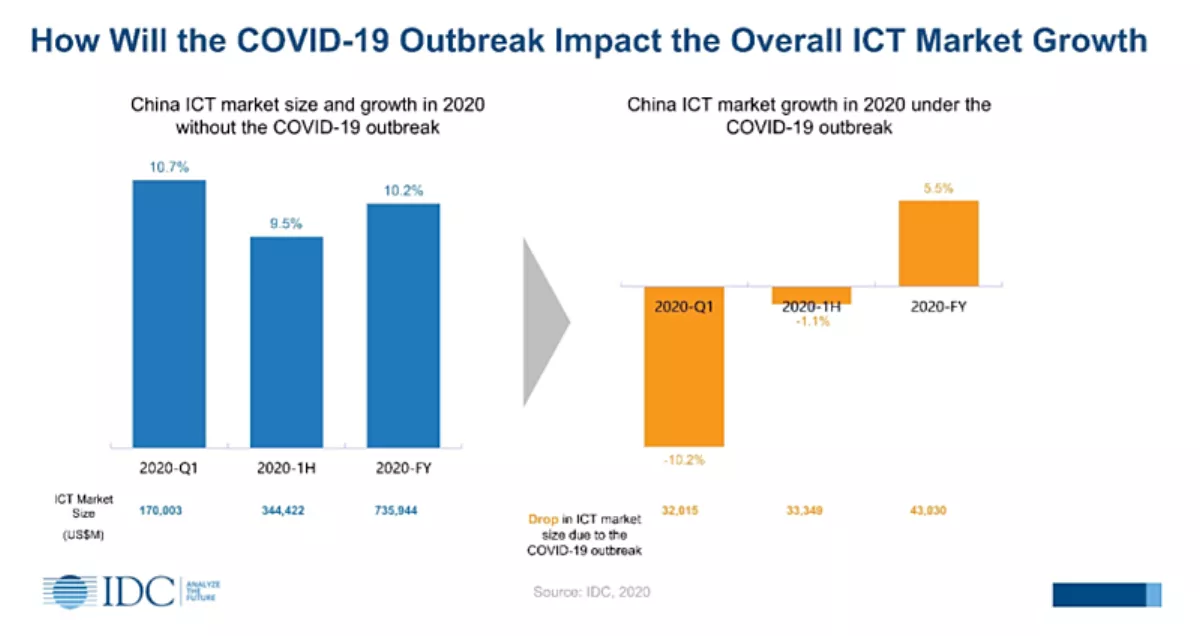

"The impact on China's ICT market will also be greater than in 2003 in view of the much greater role of ICT today than in 2003. The digital economy enabled by ICT accounted for 37.8% of the Chinese economy in 2019. The macroeconomic disruption brought by the outbreak is expected to significantly affect China's ICT market and drag it down by approximately 10% in the first quarter of 2020," she explains.

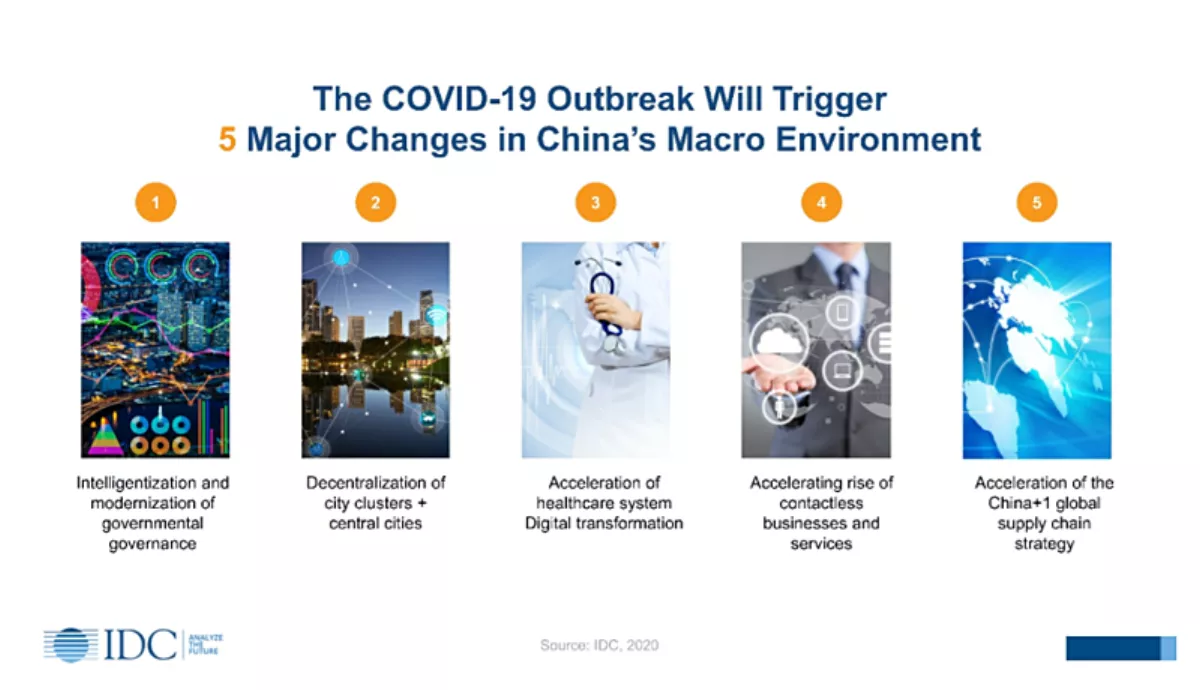

IDC forecasts that the COVID-19 outbreak will bring five major changes in China's macro environment – intelligentisation and modernisation of governmental operations, decentralisation of city clusters + central cities, accelerating healthcare system transformation, accelerating rise of contactless businesses and services, and acceleration of the China+1 global supply chain strategy – which will bring massive opportunities for China's ICT market.

Assessment of the epidemic situation

"The COVID-19 has a longer incubation period and is more infectious, making containment more difficult. In view of the strict and effective containment measures introduced by government, we expect the epidemic to peak in late February, and end in the second quarter. The disease has an overall rather low mortality rate (approximately 2.5%) and higher recovery rate and better prognostic determination," says Fok.

Impact on the Chinese economy

The outbreak will have a greater impact on the economy than the SARS outbreak in 2003 – with the impact expected to be mainly confined to the first quarter, to fade in the second quarter, and a limited full-year economic impact. IDC says the top five industries that are significantly affected by the outbreak are hospitality - food services, tourism, wholesale - retail, transportation, and manufacturing. However, the outbreak will have positive impacts on sectors including healthcare, government, the public sector, and internet - new media.

Impact on China's ICT market

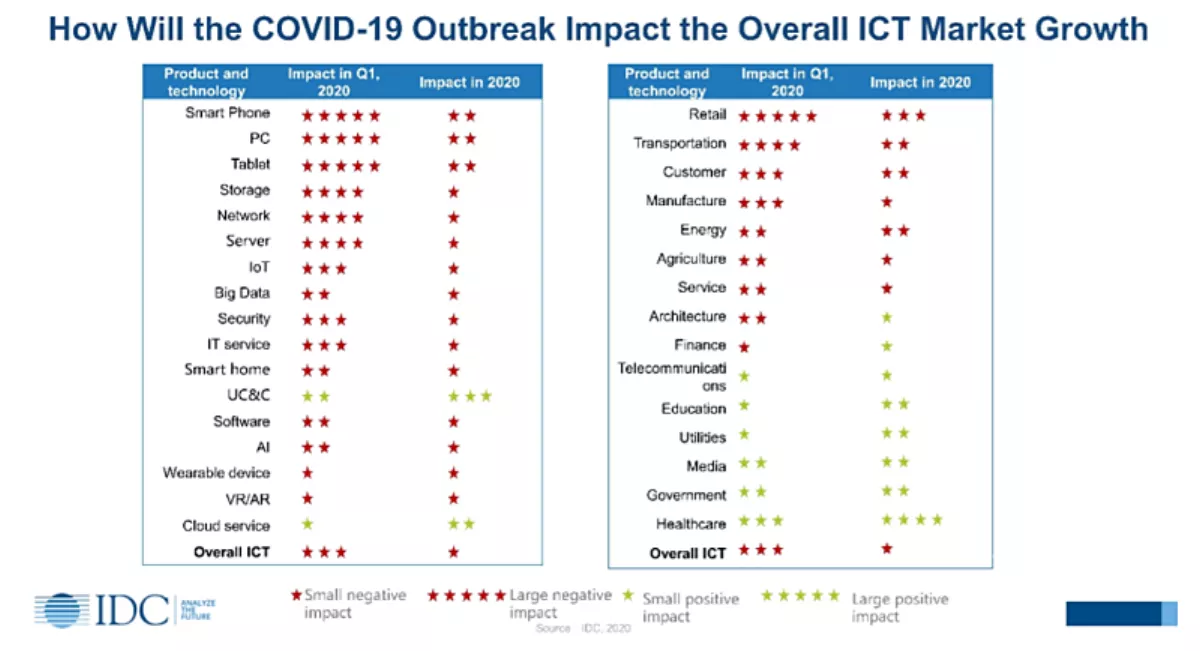

The outbreak will have a greater impact on China's ICT market compared to the Chinese economy, and its impact on hardware and consumers will be greater compared to software and businesses. The impact on the ICT market will be mainly confined to the first quarter, gradually fade in the second quarter, and a limited full-year impact.

"Due to the outbreak, we expect the ICT market to fall a record approximately 10% in the first quarter of 2020 – with at least a 30% fall for PC and smartphone sales, and greater than 15% fall for server, network and storage sales. AI and big data will be affected as well but will remain to grow, while emerging technologies such as IoT and security will experience minimal declines," says Fok.

Fok says for the full year of 2020, the central government and local governments have rolled out a lot of support measures for enterprises in addressing the negative impact on the economy with a view to stabilising it.

"The measures include investment in support of the production of key epidemic containment supplies, fiscal and credit support, tax reduction and exemption and subsidies, reduction of administrative fees, administrative streamlining, and dedicated support funds. We also expect more proactive fiscal measures and looser monetary measures to be rolled out in the second quarter and the second half of the year, in addition to increasing investment in infrastructure and relevant livelihood areas, which will continuously benefit sectors including healthcare, education, telecommunication and utilities," she says."IDC predicts a 5.5% growth for the China ICT market in 2020."

10 potential opportunities for ICT vendors

Fok says amidst the current situation disasters and challenges also pose huge business opportunities. The outbreak is expected to bring new opportunities for the ICT market:

- Opportunities for digital platforms and big data regarding the intelligentization and modernisation of governmental operations

- Opportunities for new smart cities and parks about the decentralization of city clusters + central cities

- Opportunities for online healthcare services in relation to the acceleration of healthcare system digital transformation

- Opportunities for online classroom and education, remote office and online activities, 5G industry applications, unmanned commerce and services, and fresh food eCommerce in relation to the accelerating rise of contactless businesses and services

- Opportunities for supply chain management, manufacturing and service robots in relation to the acceleration China+1 global supply chain strategy

Lianfeng Wu, associate vice president and chief analyst, IDC China, advises vendors to make full use of digital technology to develop remote collaboration capabilities and habits, implement effective marketing of online products and services, and appropriately control costs and utilise government's support policies to be well prepared for post-epidemic growth by investing in promising areas of business breakthrough and innovation with prior deployments.