Raising capital? Here’s why some pitches fly and others flop

Raising capital is not just a milestone, it is a fast, furious race against time and in the competitive world of pitching, you often have only a few minutes to convince investors that your business is worth backing. For tech companies hoping for a capital boost, first impressions matter - miss the mark and you risk not only a failed pitch but a stalled pipeline, lost hires and a shrinking window to scale ahead of your competitors.

Very few things have as much power to unlock growth, funding and strategic momentum as a pitch that truly lands. Yet, most founders are never taught how to pitch. Many default to DIY decks, AI assistance or simply endless trial and error.

Insight Investor Relations has helped channel more than $100 million into New Zealand companies with an ambition to support the next wave of standout businesses. Their latest offering, Insight Pitch, is built to decode what separates the pitches that win from those that quietly fade away.

Here's a look inside their approach - including how to avoid common pitfalls, shape a compelling narrative and understand how investors really think.

The journey of a winning pitch

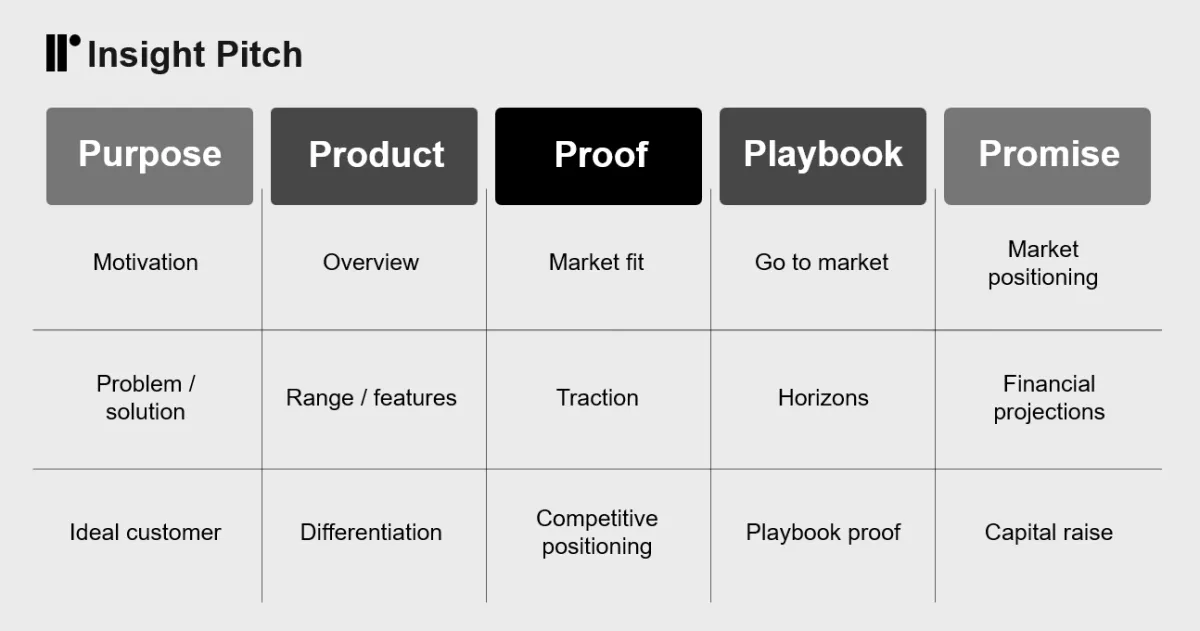

Enter the 5P Pitch FrameworkTM - the system that Insight Pitch uses to shape winning pitches.

The framework follows a deliberate path that takes investors on a journey from curiosity to conviction. It's not just about throwing numbers and slides at them - it's about building belief, layer by layer, in a way they can't ignore.

Fig 1: Insight Pitch has developed a proprietary pitch matrix that helps founders structure their pitch.

Purpose: A big, bold WHY

This is where every pitch should begin - not with what you do, but why it matters. Investors don't just back businesses; they back problems worth solving.

Your purpose needs to hit them like a lightning bolt. What's broken in the world? Why does it need fixing? And why now? This isn't a feature list - this is a hook.

A strong purpose makes investors feel something; they should walk away thinking 'I need to be part of this'.

Product: Make it real

Here's where most founders lose their audience because they get too technical, too caught up in industry jargon and assume investors will follow along. It's simple - they won't.

A great pitch makes it impossible to misunderstand what you do. Clarity is king here. The moment an investor has to pause and figure it out, you've lost them.

They should walk away knowing exactly:

- What you do in the simplest terms

- Why it's different from anything else out there

- How it solves the problem

If you don't get this part spot on, the rest of the pitch doesn't matter - they're still stuck on Slide 3 trying to decode your product!

Proof: The cold, hard facts

VCs aren't just betting on a vision; they're betting on execution. Show them that this isn't just an idea - it's a train already leaving the station.

Proof comes in many different forms:

-

Traction (Revenue, customers and user growth)

-

Team (Why are you the ones to pull this off?)

-

Validation (Market signals, partnerships, retention, referrals, tech verification)

If you don't have traction yet, you might want to show de-risking factors that prove why this bet is worth taking. Investors don't expect certainty, but they do expect a credible plan for how this becomes huge.

Playbook: Scaling with purpose

This is the piece most founders underestimate - their idea might be great, but investors have one burning question: how does this become a multi-million dollar company?

A killer go-to-market (GTM) strategy helps paint a clear picture of growth. It's not about buzzwords like 'expanding to the US' or 'acquiring customers at scale'. It's about showing exactly how you'll do that:

-

What's your first market beachhead?

-

How will you acquire your customers faster and cheaper than your competitors?

-

What makes your execution strategy bulletproof?

This is where a lot of pitches fall apart. More often than not ideas don't fail…execution does. Investors need to walk away believing you have the team, the market understanding and the plan to make the business a success.

Promise: The billion-dollar future

This is the crescendo of the presentation - the moment the investor stops thinking, "Interesting…" and starts thinking: "I need in."

How big is this opportunity? Where does this company go in three to five years? What's the true upside of this investment?

The best pitches don't just end on projections - they end on momentum. This is where FOMO kicks in and investors start seeing the scale of what's possible.

The investor cheat sheet

Having mastered the 5 Ps, it's also worth noting that pitching isn't just about getting through a deck - it's about understanding how investors think.

Here's a handy cheat sheet:

- Assume they don't know your industry. Investors are smart, but they see hundreds of ideas a year. Make it easy for them to understand what you do and see the value in what you are trying to achieve.

- Assume every person in the room is connected. Junior analysts matter because they package pitches up for decision-makers and present their recommendations to the investment committee. As such, respect every conversation.

- Assume your pitch needs ongoing work. Even the best founders refine, test and iterate their pitch because a 'good enough' pitch doesn't raise capital - a killer pitch does. Continue to progress the pitch and each investor meeting is a learning opportunity, make sure to take feedback.

- Speak their language. Investors don't care about the intricacies of your tech stack or your passion project; they care about risk and reward. It is crucial to frame your pitch in terms of potential return, market opportunity and scalability. Keep it sharp, credible and easy to repeat. If they can't pitch you to their partners, you won't get funding.

The only question left to ask is… is your pitch ready to fly?